The realm of private market transactions is witnessing a transformative era, marked by the intersection of technology and financial due diligence. Traditional approaches to due diligence, while thorough, are often time-consuming, resource-intensive, and subject to human error. But with the advent of new technologies, particularly Artificial Intelligence (AI), the landscape of due diligence is being reshaped.

Due diligence is the rigorous assessment undertaken before finalizing a deal, investment, or partnership. In private market transactions, it involves a meticulous review of financial statements, contracts, operational mechanics, legal compliance, and more. The aim is to identify potential risks, ensure that the deal’s terms are fair, and verify the accuracy of information presented by the selling or partnering party.

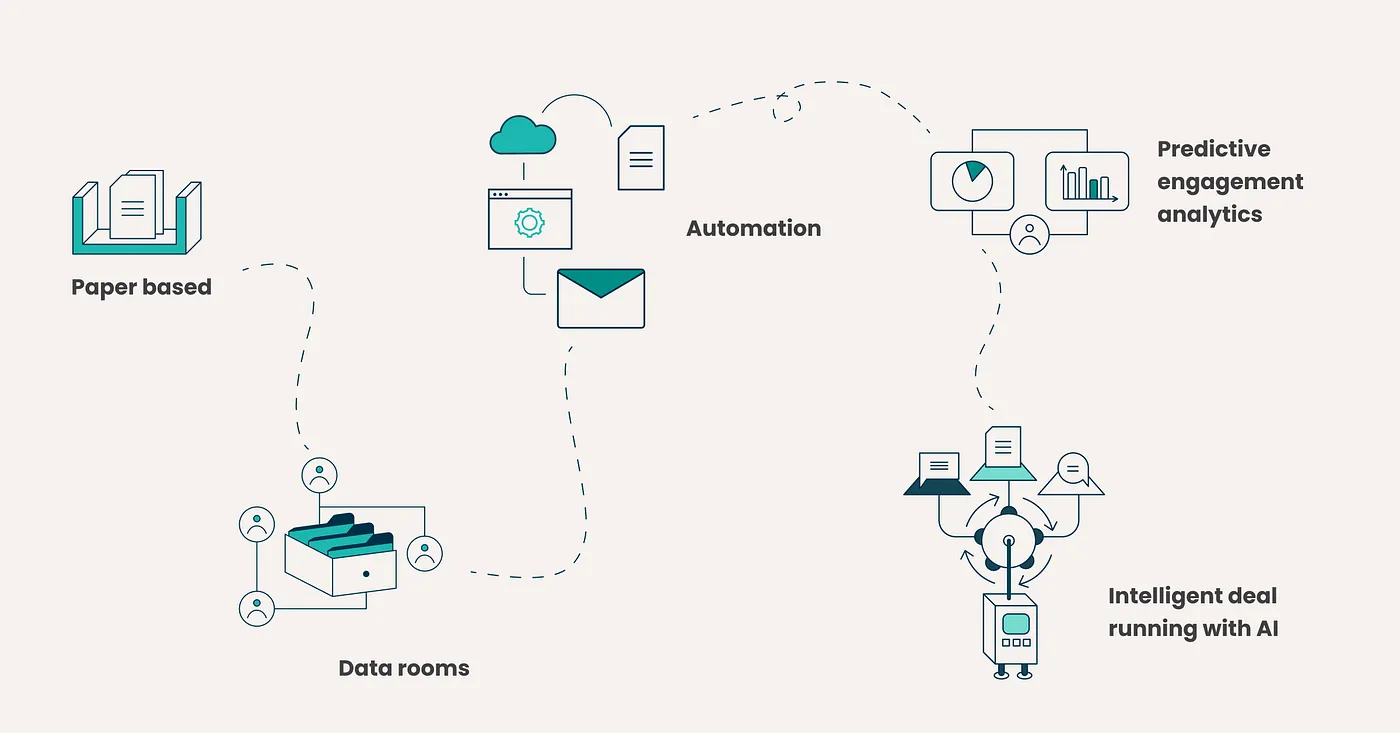

The Advent of Data Rooms: The early 2000s marked the rise of virtual data rooms — secure online repositories that housed critical documents required for financial transactions. This technology ushered in an era where key stakeholders, regardless of their geographical location, could access pertinent information securely. The data room’s ability to organize and control data access rights simplified complex transactions, especially in cross-border deals.

Automation and Advanced Analytics: With the digital age well underway, tools began emerging that could automate mundane, repetitive aspects of due diligence, freeing professionals to focus on more complex decision-making. Moreover, advanced analytics tools were integrated, converting vast data sets into actionable insights — making sense of numbers and patterns that would have been otherwise overlooked.

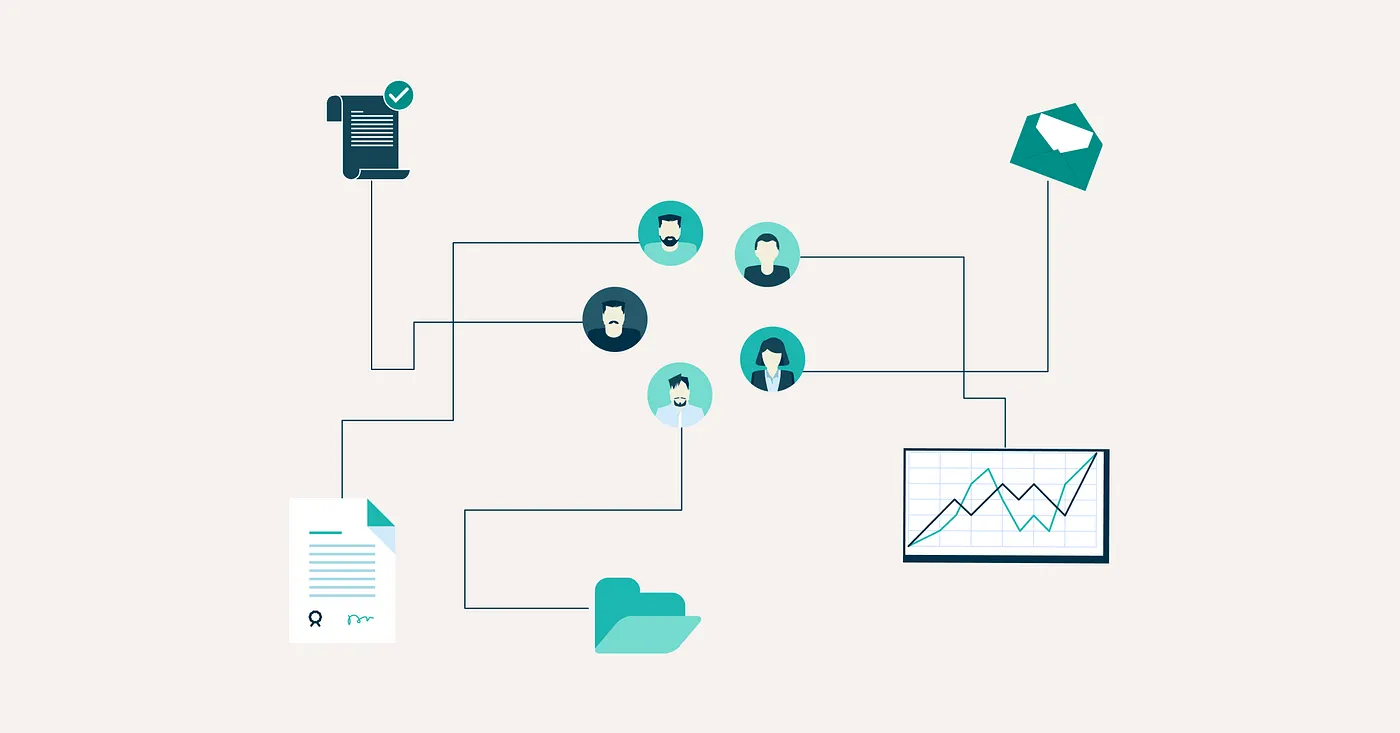

Connectivity and Real-Time Collaboration: Cloud-based platforms and collaborative tools became vital cogs in the machinery. These advancements ensured that geographically dispersed teams could collaborate efficiently in real-time, further speeding up the due diligence process. The cloud also introduced scalability, ensuring processes could handle larger datasets without a hitch.

AI’s Early Foray into Deal Execution: Artificial Intelligence is not completely new to the realm of deal execution in private markets. Its early applications primarily revolved around predictive analytics based on data room engagement insights. Virtual data rooms, rich with data on potential buyer or investor engagement, offered a unique opportunity to leverage AI.

The depth of this data — ranging from which documents are viewed and their frequency, duration, sequence of access, to even queries and comments — provided invaluable insights into stakeholder behavior.

Such metrics, analyzed through predictive analytics, offered sellers actionable feedback. This proactive approach could preemptively address concerns, customize negotiations based on real-time feedback, and even gauge the likelihood of a deal’s success based on patterns observed in past successful transactions.

The narrative of technology in business today is dominated by AI. With advancements in Machine Learning, Deep Learning, Natural Language Processing (NLP), and Predictive Analytics, AI is ushering businesses into an era of unprecedented innovation and optimization. Particularly intriguing is the ongoing discourse on AI ethics, ensuring these powerful technologies are wielded with responsibility. As Quantum Computing edges closer to practical application, its potential integration with AI suggests we’re on the precipice of another technological leap.

In the labyrinthine world of Artificial Intelligence, a few technological marvels stand tall, carving pathways for the entire AI ecosystem.

Machine Learning (ML) stands as the vanguard of this AI revolution. It was as early as 1959 when Arthur Samuel gave life to the term “Machine Learning.” But the real turn of events happened in the late 20th century and early 21st. The 1986 introduction of backpropagation marked a pivotal moment, as it considerably accelerated the training of multi-layer neural networks, laying the foundation for deep learning. A moment of epiphany in the ML world was in 2016 when DeepMind’s AlphaGo, powered intricately by ML, overthrew world champion Lee Sedol in Go.

With its ability to sift through vast transactional data, ML’s importance in the private market is undeniable. It extracts patterns and informs decisions, a trait invaluable for the market’s fluidity.

NLP is about making machines understand, interpret, and even generate human-like text. The Turing Test in 1950 was perhaps the first spark. Fast forward to 2011, and IBM’s Watson reigned supreme on “Jeopardy!” — an NLP milestone. OpenAI’s GPT-2 (2018) and GPT-3 (2020) showcased breakthroughs in text comprehension and generation.

In private markets, where understanding sentiment and analyzing verbose financial documents is pivotal, NLP proves indispensable.

Pioneered by Ian Goodfellow’s GANs in 2014 and later by OpenAI’s DALL-E in 2020, Generative AI focuses on creating new, realistic content. In private markets, it can be harnessed for scenario modeling, enabling analysts to visualize potential market shifts.

Predictive Analytics combines statistical algorithms with ML to forecast outcomes. Palantir (2009) and Salesforce integrations (2010s) became hallmarks. For private markets, this capability provides a strategic lens into enterprise trajectories and market fluctuations.

By the 2010s, RPA emerged as a go-to solution for business process streamlining. UiPath (2018) highlighted its ubiquity. In private markets, RPA ensures accuracy in repetitive tasks during transactional processes.

Together, these technologies underpin and continually reshape AI’s role in due diligence.

The sophistication and capabilities of AI are reshaping the way due diligence is approached in private market transactions:

The infusion of AI into due diligence transcends mere automation — it’s a paradigm shift. This digital renaissance enhances decision-making precision, risk assessment, and execution speed.

For market professionals, the future promises a powerful fusion: AI amplifying human expertise. Together, they form the bedrock of successful private market transactions.